EveryDollar promises to help you get out of debt by sticking to a user-friendly budget. But does it work? Read this review to learn more about this budgeting program.

- What Is EveryDollar?

- Pros of EveryDollar

- Cons of EveryDollar

- How EveryDollar Works

- Dealing With Leftover Funds

- EveryDollar Plus

“EveryDollar app is just your budget plan, instead of using paper and pencil and writing your income at the top of the page and giving every dollar a name down the page until every dollar is. Review Summary: EveryDollar is a simple, free budgeting app, perfect for Dave Ramsey Fans. It's easy to get started, and you can create a budget in less than 10 minutes. The paid version (Ramsey +) features a Baby Steps app, automatic transaction import, and access to Financial Peace University online. Apr 09, 2021 EveryDollar. Review Summary: EveryDollar is a simple, free budgeting app, perfect for Dave Ramsey Fans. It's easy to get started, and you can create a budget in less than 10 minutes. The paid version (Ramsey +) features a Baby Steps app, automatic transaction import, and access to Financial Peace University online.

Feb 11, 2020 Every Dollar is a budgeting app that works on the budget principles of Dave Ramsey's Financial Peace University and his 7 Baby Steps. It was created by the personal finance guru to help make budgeting easier for users, so they can achieve financial freedom.

What Is EveryDollar?

EveryDollar helps you create a plan for your income and reach financial stability. The program follows Dave Ramsey's Zero-Based Budgeting.

As you work through the month, every transaction is recorded in the app. If you have money left at the end of the month, you can roll it into your savings account.

Keep reading to see if EveryDollar is right for you.

What Is Zero-Based Budgeting?Every Dollar App Image

With this method, you categorize every dollar you earn, be it for spending, saving, giving, or investing.If you have 'extra' money, assign it one of those categories, preferably saving or investing. By the end of the month, you should have zero dollars left.

Pros of EveryDollar

Easy Setup

Depending on how many categories you need, you can set up your account in as little as ten minutes.

Quickly Add Transactions

Once you are setup, you can enter the transaction information, including the amount spent, vendor, and category.

Multiple Categories

This makes it easy to get as specific as possible with your spending and can help you avoid overspending in certain categories.

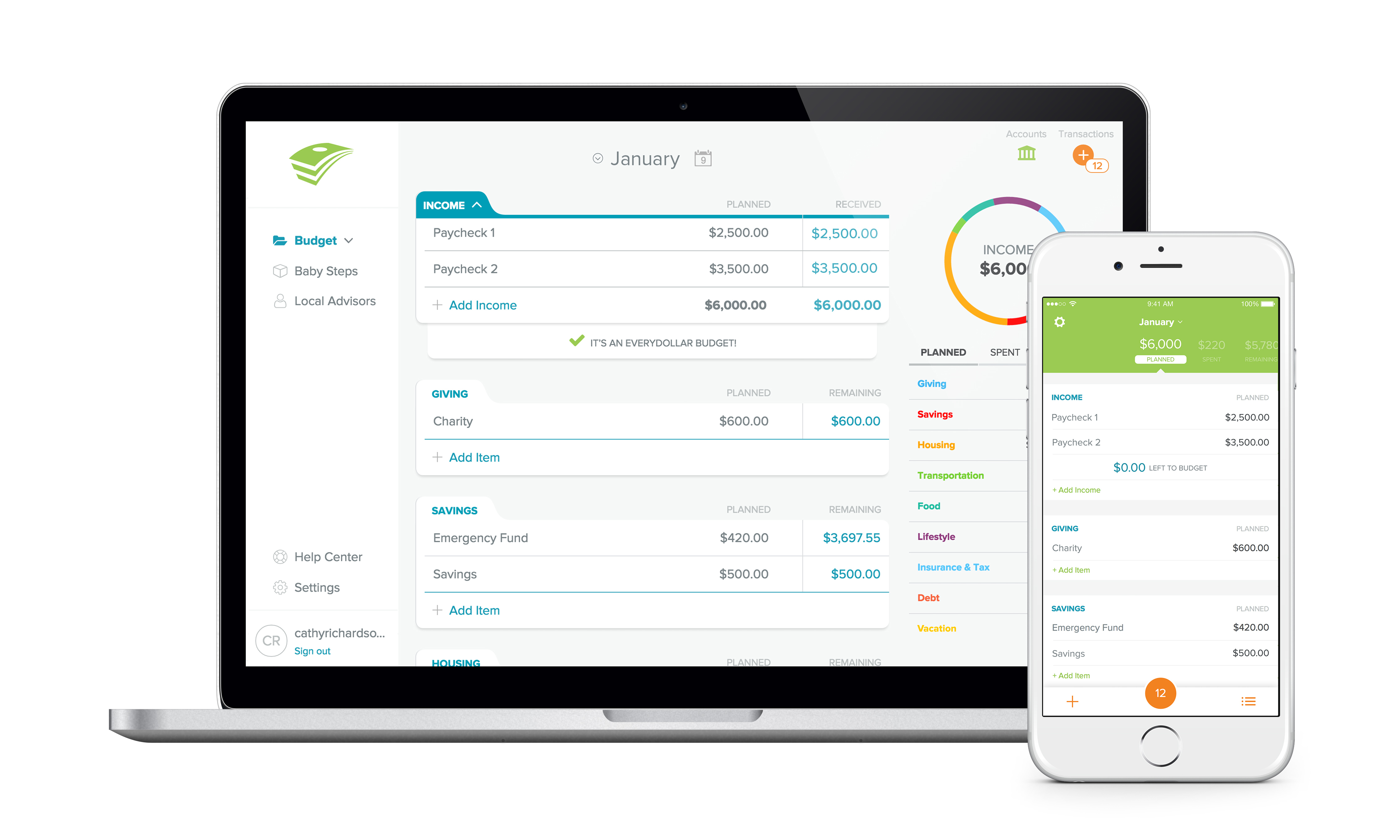

Accessible on Desktop, Mobile Phone, and Tablet

All data syncs automatically, making it easy to budget wherever it is convenient for you.

Once one step is completed, you move on to the next. The steps are:

- Save $1,000 for an emergency fund

- Use the debt snowball method to get out of debt

- Save up to six months of expenses in an emergency fund

- Invest in your 401(k) or IRA (at least 15% of your income)

- Save for your child's college fund

- Pay off your mortgage

- Build wealth and give to charity

Cons of EveryDollar

Can't Sync Bank Account with Free App

In the free version, every transaction must be entered manually. This can be time-consuming if you have a lot of transactions each month and leaves room for clerical error.

Budgeting Services Only

If you want something more complex, such as investment options, EveryDollar doesn't offer it.

Expensive to Upgrade

EveryDollar Plus costs $129.99 per year. They don't offer monthly installment payments.

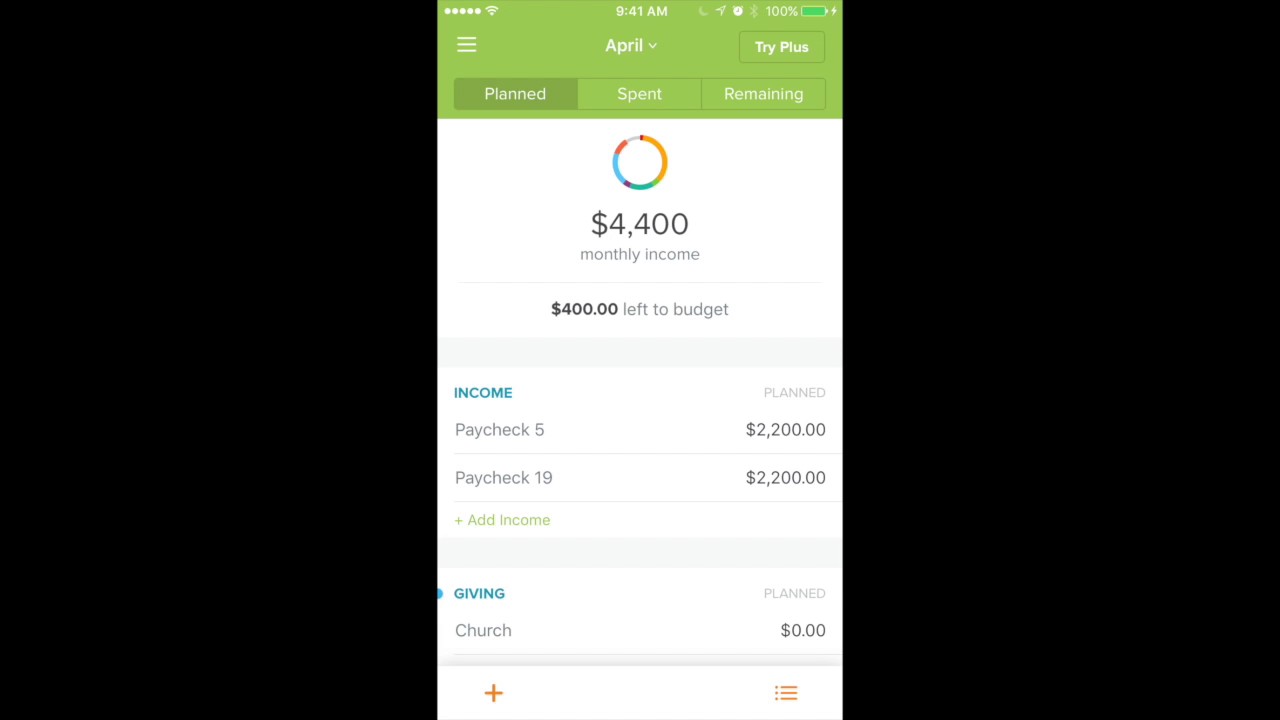

How EveryDollar Works

Signing up for EveryDollar is simple. Enter your name, country, zip code, and email address, and create your password.

Once you sign up, you can create your budget. This includes:

- Categories

EveryDollar comes prepopulated with eight categories. You are free to add as many custom categories as you need, though. - Income

Figure out the frequency of your paychecks and enter them accordingly. - Planned Expenses

You'll know exact amounts for fixed expenses like your mortgage. Other categories, such as food and household essentials, will require an estimate. - Savings Fund

Any unallocated money can go into a categorized savings fund. Examples include emergency funds, Christmas funds, or vacation funds. You can also track progress toward that goal.

Dealing With Leftover Funds

If you use the true spirit of the EveryDollar program, you won't roll the funds over into the next month. Instead, you'll apply any extra funds toward your debt.

Using the Baby Step Program, you should allocate the funds toward the appropriate step. Typically, users of EveryDollar are on the first few steps of the Baby Step Program.

These include:

- Save a $1,000 emergency fund

- Use the snowball method to pay off debt

- Save between 3 and 6 months of expenses

- Start investing, saving for college, and paying off your home

With Dave Ramsey's Snowball Method, start by paying as much as possible towards your smallest debt. At the same time, make minimum payments toward your other debts.

Once you pay off the smallest debt, take the amount you have been paying and combine it with the minimum payment of the next smallest debt.

Keep using this method until you are out of debt completely.

EveryDollar Plus

If you pay $129.99/year for EveryDollar Plus, you can skip manually entering transactions. Each night your account will sync with connected bank accounts and credit cards.

The only thing you have to do the next day is categorize the expenses. This is a drag-and-drop system, so it only takes a few seconds per transaction.

You can try EveryDollar Plus for 15 days free of charge. After 15 days, you'll be charged $129.99, so make sure you keep track of your cancellation date should you not care for the app after trying it.

How It Compares

Mint

Both Mint and EveryDollar are free budgeting apps. Neither program offers bill pay options, but Mint does offer the ability to track investments.

YNAB

YNAB doesn't have a free version. After their free 34-day trial period, it costs $84.00/year. Unlike EveryDollar, YNAB does track investments.

YNAB syncs with your bank accounts, and focuses on strict budgets for each category. With YNAB, if you spend all of your allocated money for a specific category, you stop spending in that category until you get paid again.

Quicken

Quicken doesn't have a free version; you pay annually for the service. It offers more complex features than EveryDollar, including investment management, bill paying, retirement planning, and credit score monitoring depending on the level you choose.

Bottom Line

EveryDollar can be effective for those looking for a basic budgeting program. If you are in debt and need help allocating your funds, this program could get you started.

If you need something more complex or have too many transactions to enter manually, you may want to explore your other options.

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Read Next:

EveryDollar promises to help you get out of debt by sticking to a user-friendly budget. But does it work? Read this review to learn more about this budgeting program.

- What Is EveryDollar?

- Pros of EveryDollar

- Cons of EveryDollar

- How EveryDollar Works

- Dealing With Leftover Funds

- EveryDollar Plus

What Is EveryDollar?

EveryDollar helps you create a plan for your income and reach financial stability. The program follows Dave Ramsey's Zero-Based Budgeting.

As you work through the month, every transaction is recorded in the app. If you have money left at the end of the month, you can roll it into your savings account.

Keep reading to see if EveryDollar is right for you.

What Is Zero-Based Budgeting?With this method, you categorize every dollar you earn, be it for spending, saving, giving, or investing.

If you have 'extra' money, assign it one of those categories, preferably saving or investing. By the end of the month, you should have zero dollars left.

Pros of EveryDollar

Easy Setup

Depending on how many categories you need, you can set up your account in as little as ten minutes.

Quickly Add Transactions

Once you are setup, you can enter the transaction information, including the amount spent, vendor, and category.

Multiple Categories

This makes it easy to get as specific as possible with your spending and can help you avoid overspending in certain categories.

Accessible on Desktop, Mobile Phone, and Tablet

All data syncs automatically, making it easy to budget wherever it is convenient for you.

Once one step is completed, you move on to the next. The steps are:

- Save $1,000 for an emergency fund

- Use the debt snowball method to get out of debt

- Save up to six months of expenses in an emergency fund

- Invest in your 401(k) or IRA (at least 15% of your income)

- Save for your child's college fund

- Pay off your mortgage

- Build wealth and give to charity

Cons of EveryDollar

Can't Sync Bank Account with Free App

In the free version, every transaction must be entered manually. This can be time-consuming if you have a lot of transactions each month and leaves room for clerical error.

Budgeting Services Only

If you want something more complex, such as investment options, EveryDollar doesn't offer it.

Expensive to Upgrade

EveryDollar Plus costs $129.99 per year. They don't offer monthly installment payments.

How EveryDollar Works

Signing up for EveryDollar is simple. Enter your name, country, zip code, and email address, and create your password.

Once you sign up, you can create your budget. This includes:

- Categories

EveryDollar comes prepopulated with eight categories. You are free to add as many custom categories as you need, though. - Income

Figure out the frequency of your paychecks and enter them accordingly. - Planned Expenses

You'll know exact amounts for fixed expenses like your mortgage. Other categories, such as food and household essentials, will require an estimate. - Savings Fund

Any unallocated money can go into a categorized savings fund. Examples include emergency funds, Christmas funds, or vacation funds. You can also track progress toward that goal.

Dealing With Leftover Funds

If you use the true spirit of the EveryDollar program, you won't roll the funds over into the next month. Instead, you'll apply any extra funds toward your debt.

Using the Baby Step Program, you should allocate the funds toward the appropriate step. Typically, users of EveryDollar are on the first few steps of the Baby Step Program.

These include:

- Save a $1,000 emergency fund

- Use the snowball method to pay off debt

- Save between 3 and 6 months of expenses

- Start investing, saving for college, and paying off your home

With Dave Ramsey's Snowball Method, start by paying as much as possible towards your smallest debt. At the same time, make minimum payments toward your other debts.

Once you pay off the smallest debt, take the amount you have been paying and combine it with the minimum payment of the next smallest debt.

Keep using this method until you are out of debt completely.

EveryDollar Plus

If you pay $129.99/year for EveryDollar Plus, you can skip manually entering transactions. Each night your account will sync with connected bank accounts and credit cards.

The only thing you have to do the next day is categorize the expenses. This is a drag-and-drop system, so it only takes a few seconds per transaction.

You can try EveryDollar Plus for 15 days free of charge. After 15 days, you'll be charged $129.99, so make sure you keep track of your cancellation date should you not care for the app after trying it.

How It Compares

Mint

Both Mint and EveryDollar are free budgeting apps. Neither program offers bill pay options, but Mint does offer the ability to track investments.

YNAB

YNAB doesn't have a free version. After their free 34-day trial period, it costs $84.00/year. Unlike EveryDollar, YNAB does track investments.

YNAB syncs with your bank accounts, and focuses on strict budgets for each category. With YNAB, if you spend all of your allocated money for a specific category, you stop spending in that category until you get paid again.

Quicken

Quicken doesn't have a free version; you pay annually for the service. It offers more complex features than EveryDollar, including investment management, bill paying, retirement planning, and credit score monitoring depending on the level you choose.

Bottom Line

EveryDollar can be effective for those looking for a basic budgeting program. If you are in debt and need help allocating your funds, this program could get you started.

Everydollar App Review

If you need something more complex or have too many transactions to enter manually, you may want to explore your other options.

Every Dollar App Sign In

Write to Kim P at feedback@creditdonkey.com. Follow us on Twitter and Facebook for our latest posts.

Every Dollar App Login

Read Next: